Version: 2019/9/2

(The Chinese edition is here: https://talk.nervos.org/t/ckb/5230)

Contents

1. Economic Properties of CKByte

1.3 Risk-free Interest Rate Enabled by NervosDAO

2. Mathematical Expressions and Core Features of CKByte Issuance Model

2.2.3 Secondary Issuance and Distribution

2.2.4 Inflation Rate and NervosDAO Interest Rate

2.2.5 Deposits and Withdrawals

2.3.2 Steady State and Its Features

3. A Numerical Test on CKByte Issuance Model

This paper is a technical supplement to Wang et al. (2019), who provided an overview of the economic model of Nervos. It aims to introduce the CKByte issuance model of Nervos in terms of economic analysis, mathematical expressions and results from a numerical test. This paper is composed of 4 parts. It begins with the economic properties of CKByte. The second part is concerned with the mathematical expressions and core features of the CKByte issuance model. Then, it presents the results from a numerical test on the CKByte issuance model. And the final part draws upon the entire paper.

1. Economic Properties of CKByte

CKByte, which is native to Nervos blockchain, possesses the common properties of a token. It serves as a method of payment (i.e. medium of exchange), a unit of account and an economic incentive for the economic activities within the Nervos ecosystem. In that sense, it is in its essence not different from BTC or ETH.

CKByte is unique on three fronts, that is, utility on Layer 1, value capture on Layer 2, and risk-free interest rate enabled by NervosDAO. Due to the three peculiarities, the price of CKByte (in fiat money terms, similarly hereinafter) is inherently stable, which enables it to be a store of value.

1.1 Utility on Layer 1

On the Layer 1 of Nervos, data storage has a cost. It costs 1 CKByte to store 1 byte of data. The Layer 1 can be compared to a collection of arable land, and data storage is like planting crops on the land. Hence, 1 CKByte corresponds to a unit of land. This is why CKByte is considered to have the properties of an estate as pointed out by Wang et al. (2019).

The data stored on the Layer 1 is publicly available and cannot be tampered with. And CKByte is a kind of scarce resource due to its issuance model (see part 2). Therefore, storing data on the Layer 1 of Nervos can bring utility to the data owner. The utility depends on how valuable the data is to its owner. The higher the value is, the higher the utility is. For example, given the same storage space, storing one’s personal honors undoubtedly provides higher utility than storing stale gossips.

The price of CKByte exerts a direct effect on the way users store their data with CKByte. Other things being equal, when the price of CKByte rises, less valuable data will no longer be stored. The CKBytes used to store the data will be released and put back into circulation, thus increasing the effective supply of CKByte and stabilizing its price. Conversely, when the price of CKByte drops, more data is worth storing. Some CKBytes will be used to store data and go out of circulation, thus shrinking the effective supply of CKByte and propping up its price.

CKByte derives its price stability from its utility, which is much like precious metal. In addition to being used as currency, precious metal has consumer and industrial uses, such as jewelry and utensils. All else being equal, when the price of precious metal goes up, some jewelry and utensils will be melted and enter circulation, leading to an increase in effective supply and stabilized price. When the price of precious metal goes down, some precious metal will be made into jewelry and utensils, and removed from circulation, decreasing the effective supply and supporting the price of precious metal.

1.2 Value Capture on Layer 2

Value capture is a term of public finance. The investment from the government in public infrastructure always adds value to the private estates in the neighborhood. For example, if the government builds a new metro line, the price of the real estate nearby will rise. It shows that the investment in public infrastructure has a spillover effect. Then, should the government be entitled to recover a portion of increased valuation of private land? If value capture does not exist, the costs and benefits of public investment can hardly be equally allocated between the government and the private sector, thus doing harm to the efficiency and sustainability of public infrastructure.

As Wang et al. (2019) pointed out, how Layer 1 can capture the value from Layer 2 was also a problem for the blockchain industry. It is the participants of Layer 1 that provide underlying security. If they fail to benefit from the growth of Layer 2, they will be discouraged from doing their job, which can in turn impede the growth of Layer 2.

In Nervos, the participants of Layer 2 require to store the state of Layer 2 on Layer 1 by using CKBytes. As the growth of Layer 2 accelerates and leads to a higher demand on CKB, the price of CKByte will go up and thus benefit the participants of Layer 1. In this way, benefits can be shared between Layer 1 and Layer 2.

1.3 Risk-free Interest Rate Enabled by NervosDAO

Generally, CKBytes are held in three ways. First, they are used to store data and go out of circulation. Second, they are in idle state and stay liquid, such as those deposited in crypto exchanges. Third, they are kept by holders, who are not intended to sell. As for the third case, it is recommended to lock CKBytes in NervosDAO and earn interest (more on that in the second part). The return on CKByte deposits is what we call the risk-free interest rate of NervosDAO. It should be noted that locking CKBytes in NervosDAO does not free holders from the price volatility. Hence, the risk-free interest rate of NervosDAO is largely different from that of fiat money (i.e, government bond yield).

The deposit mechanism has two benefits. On the one hand, it can ensure the hodlers suffer no loss due to the dilution incurred by the newly-issued CKBytes (For details, see the second part). On the other hand, to earn the risk-free interest rate, some holders may remove their CKBytes from circulation for deposits, which can help decrease the effective supply of CKByte and support its price.

To sum up this part, a comparison is made between CKByte and other assets from the perspective of properties (payment/utility/securities), supply and demand side, and price stability mechanism in the Table 1, which is shown below:

Table 1: A Comparison between CKByte and Other Assets

| Properties | Description | CKB | Precious Metal (Represented by Gold) | Bitcoin | Credit Money | Stock | Commodity (Represented by Oil) |

|---|---|---|---|---|---|---|---|

| Payment | A method of payment | Yes | Yes | Yes | Yes | No | No |

| Utility | Intrinsic value in use | Yes, CKBytes are used to store data. | Yes, precious metal has consumer and industrial uses. | No | No | No | Yes, commodities have a wide range of uses. |

| Securities | A claim on some asset or stream of future cash flows | No | No | No | Yes, monetary base is a liability of the central banks’ balance sheet, while deposits are a debt from commercial banks. | Yes, a stock represents a claim on the company’s net assets. | No |

| Supply Side | How are the assets created or issued? | Its supply is determined by an algorithm and not affected by its price. | There is a hard cap. Its supply is elastic and affected by its price. | There is a hard cap. Its supply is determined by an algorithm and not affected by its price. | There is no hard cap. Its supply is determined by the behaviors of central banks and commercial banks. The price (i.e. interest rate) affects the supply. | There is no hard cap. Its supply is determined by the company, but has to meet regulatory requirements. The price affects the supply. | There is a hard cap. Its supply is elastic and affected by its price. |

| Demand Side | Why do we hold the assets? | It can be used for payment, speculation/investment, data storage and earning interest on deposits. | It can be used for payment, speculation/investment, consumption and industrial production. | It can be used for payment, and speculation/investment. | It can be used for payment, speculation/investment, and earn interest on deposits. | It can be used for speculation/investment, and earning dividend income. | It can be used for speculation/investment, consumption and industrial production. |

| Price Stability Mechanism | Is there a mechanism that stabilizes the price of assets? | Yes, see the prior section. | Yes, see the prior section. | No. | Yes, the monetary and foreign exchange policies of central banks serve this purpose. | Yes, stock prices depend on fundamentals. | Yes, its price stability mechanism is similar to precious metal’s. |

2. Mathematical Expressions and Core Features of CKByte Issuance Model

2.1 Key Points

Four major considerations are involved in the design of CKByte issuance model. First, a hard cap is set in the CKB’s token issuance model just like Bitcoin’s. Hence, the block rewards given to PoW miners are reduced by half every given period of time. The sum of block rewards is considered as the base issuance of CKByte. With its technology tested for over a decade, Bitcoin’s issuance model has been proven to be the most recognized among the existing token issuance models in the market. To date, a large number of cryptocurrencies have copied the model in their design.

Second, as the block reward approaches zero, PoW miners may be disincentivized. To avoid it, CKB’s model also introduces uncapped secondary issuance, which is similar to ETH’s token issuance model. In the secondary issuance, the number of CKBytes minted per block remains unchanged. There is no answer to the question that if a fee is enough to incentivize PoW miners forever. That is the major reason why we introduce the secondary issuance. Different from the base issuance, the secondary issuance of CKBytes are allocated among the major players of Layer 1 instead of going to PoW miners entirely.

Third, storing data on Layer 1 requires a fee. On the one hand, those who store the data on Layer 1 should pay a fee on an ongoing basis for occupying the storage space of Nervos system, which is similar to the state rent on Ethereum. On the other hand, PoW miners ensure the security of Layer 1, whose value is directly relevant to the size of data stored on it. In theory, the more data Layer 1 stores, the higher rewards PoW miners should receive. The secondary issuance of CKBytes serves the above two purposes. If holders use their CKBytes to store data, they will be excluded from the secondary issuance. Hence, their CKBytes will be constantly diluted by the secondary issuance. In other words, these holders have to bear the cost of occupying storage space by paying an inflation tax. Besides, the proportion of CKBytes distributed to PoW miners in the secondary issuance is equal to that of CKBytes used for data storage.

Fourth, holders are allowed to deposit their CKBytes into NervosDAO for rewards so that their holdings will never be diluted by the secondary issuance. The rewards enable Nervos system to achieve a steady state, which can eliminate the dilution effect of the secondary issuance (more on that below).

Fifth, the CKByte issuance model can hardly work without the consensus protocol of Nervos. Nervos’ consensus protocol has three fixed target values (Zhang Ren, 2018). They are (1) the length of difficulty adjustment period (which is called epoch), (2) the number of CKBytes issued per epoch (which is measured in CKBytes), and (3) an orphan rate. The Nervos system dynamically adjusts the number of blocks mined per epoch and the amount issued per block according to the three fixed target values.

Overall, CKB’s token issuance model shares not only plenty of similarities, but also many key differences with Bitcoin’s (see Table 2).

Table 2: Similarities & Differences between CKB’s Token Issuance Model & Bitcoin’s

| CKB | Bitcoin | |

|---|---|---|

| Hard cap | Base issuance has a hard cap, while secondary issuance do not. | The hard cap is 21 million. |

| Halving period | 4 years | 4 years (until a total of 210,000 blocks are mined) |

| Difficulty adjustment period/epoch | Undetermined | 14 days (every 2,016 blocks are mined) |

| Issuance amount per epoch | Predetermined. Base issuance reduces exponentially over time, while secondary issuance remains unchanged. | Predetermined, and reduces exponentially over time |

| Target orphan rate | Undetermined. It ranges from 0.05 to 1/3. | It is not a system-level target, but close to 0. |

| Block amount per epoch | Adjusted dynamically by system | 2016 |

| Issuance amount per block | Adjusted dynamically by system | Predetermined, and reduces exponentially over time, i.e. 50→25→12.5→6.25→3.125… |

2.2 Mathematical Expressions

The following mathematical expressions use the same symbols as Nervos Network (2019a) in order to make the theoretical analysis more in line with the engineering implementation.

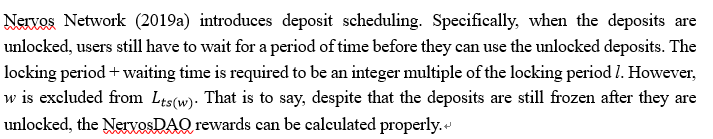

2.2.1 Parameter Definitions

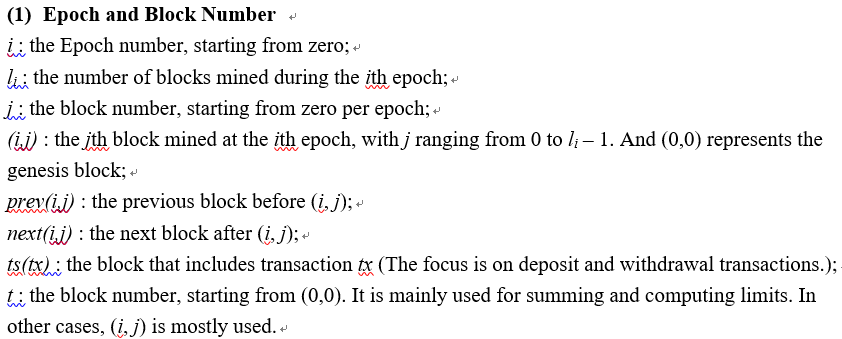

The following variables iterate every time when a new block is mined and are initialized in the first place:

![]()

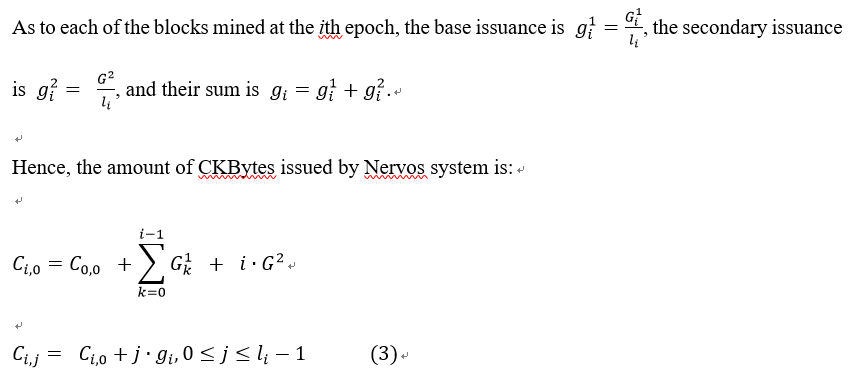

2.2.2 Base Issuance

Base issuance takes the following form:

and so on…

It can be generalized as:

![]()

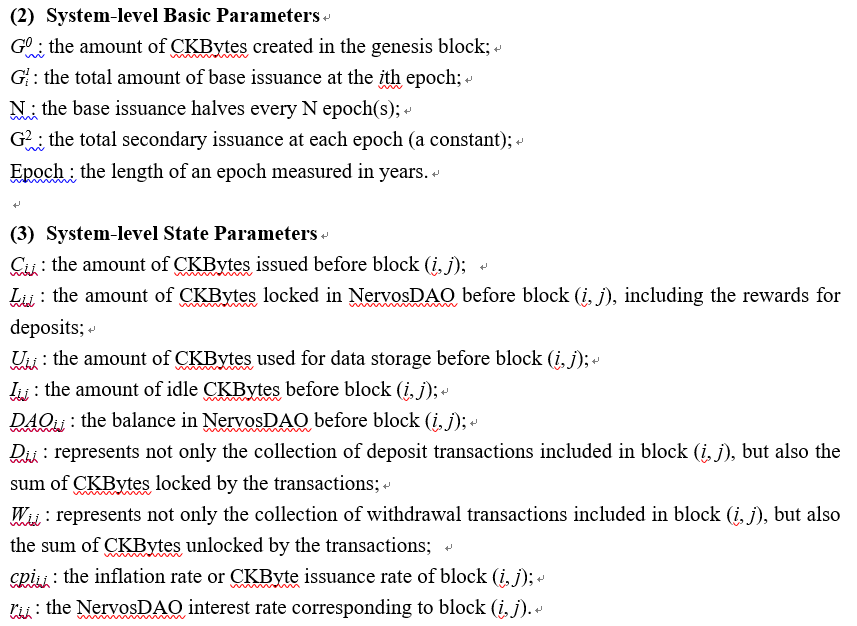

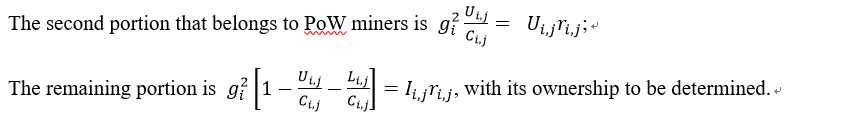

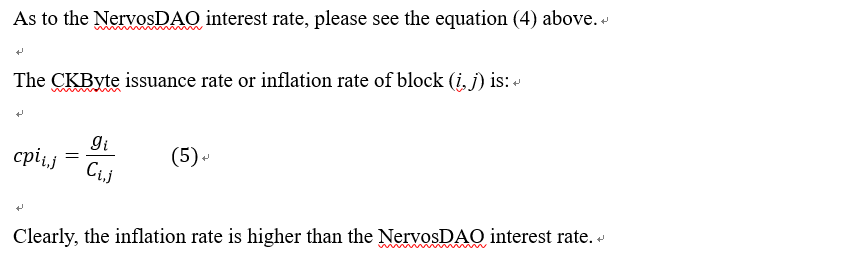

2.2.3 Secondary Issuance and Distribution

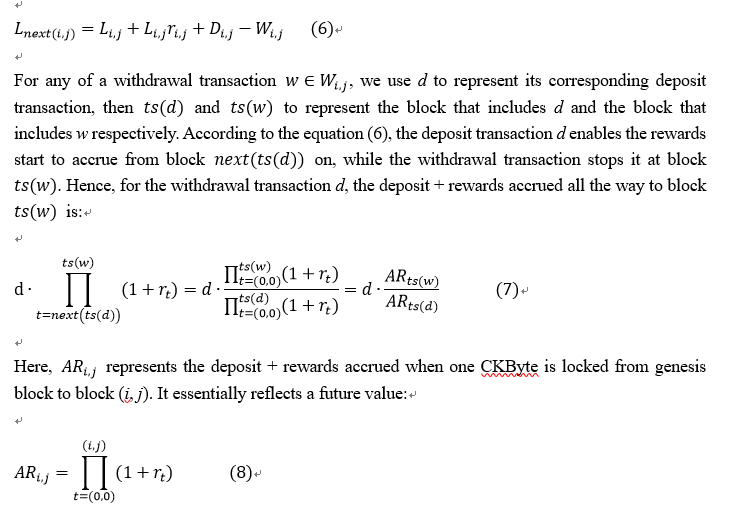

2.2.4 Inflation Rate and NervosDAO Interest Rate

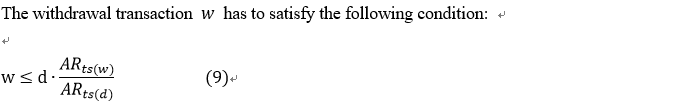

2.2.5 Deposits and Withdrawals

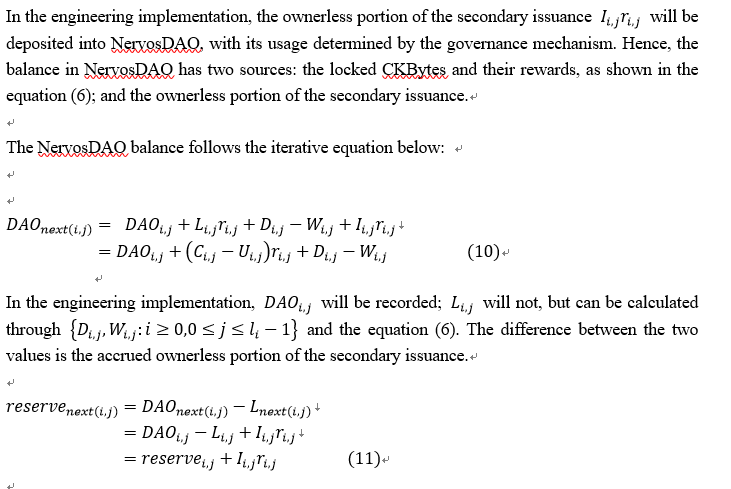

The amount of CKBytes locked in NervosDAO (including rewards) follows the iterative equation below:

2.2.6 NervosDAO Balance

2.3 Core Features

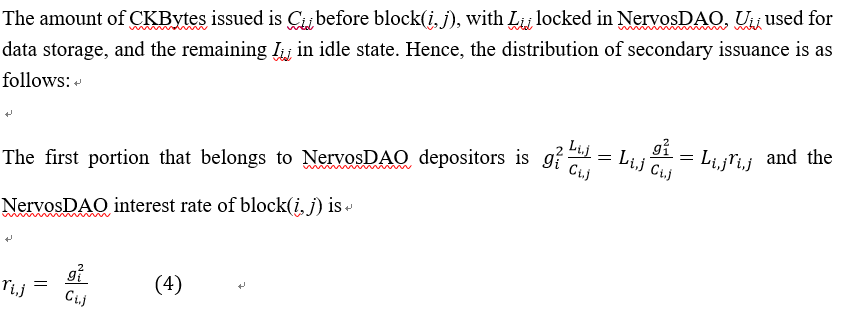

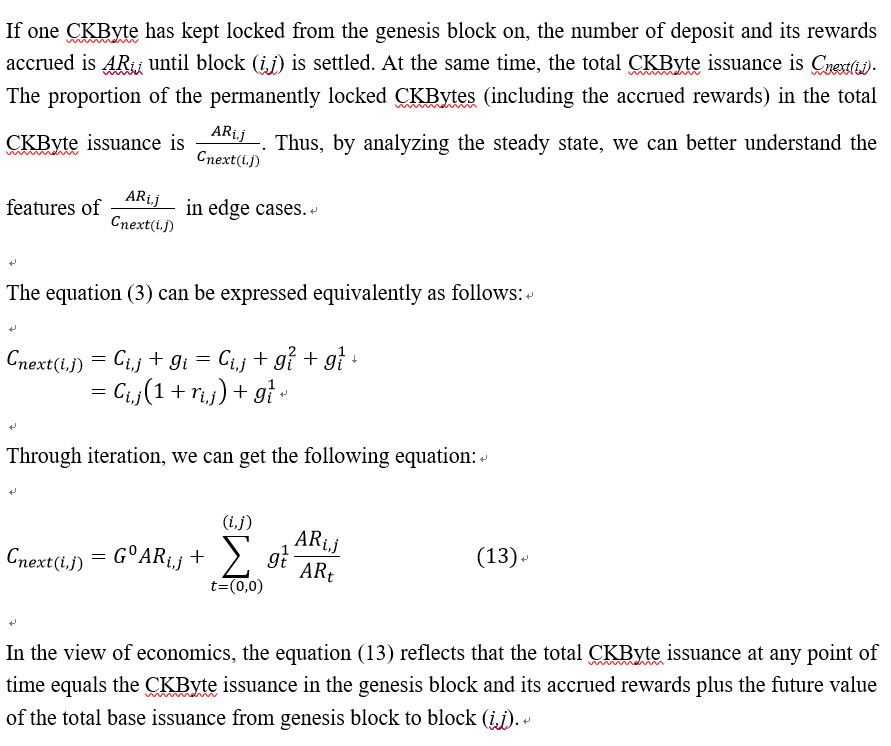

2.3.1 Regime Shift

The focus of CKByte issuance model is shifting from base issuance to secondary issuance with the passage of time. In it lies the regime shift, which can be measured in different ways. We mainly consider the point of time when secondary issuance exceeds base issuance:

![]()

The equation (12) implies that the secondary issuance matters more to PoW miners after the ith epoch.

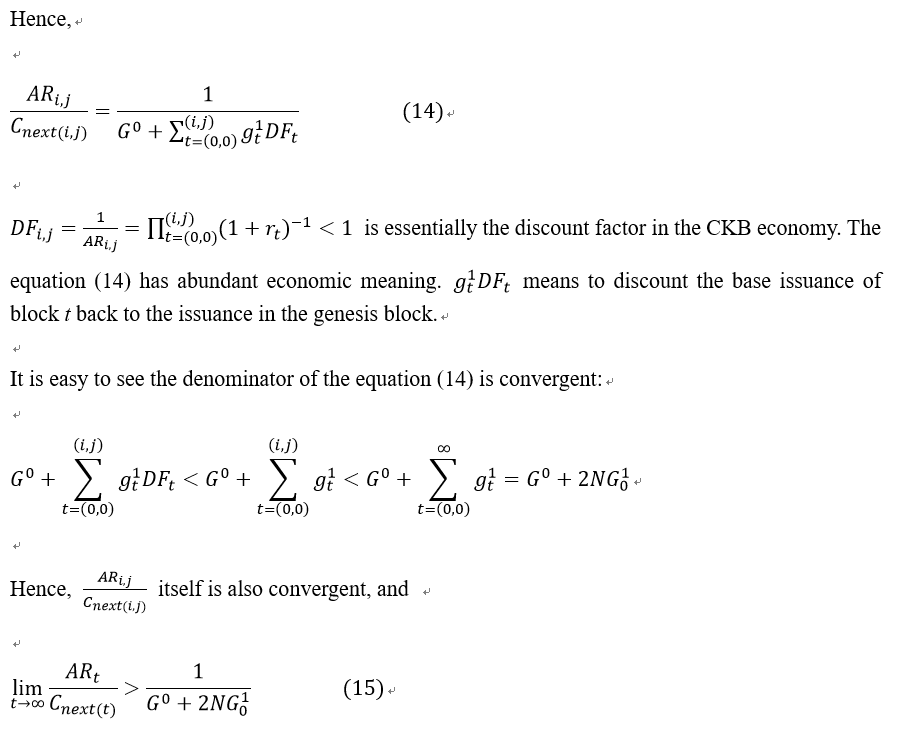

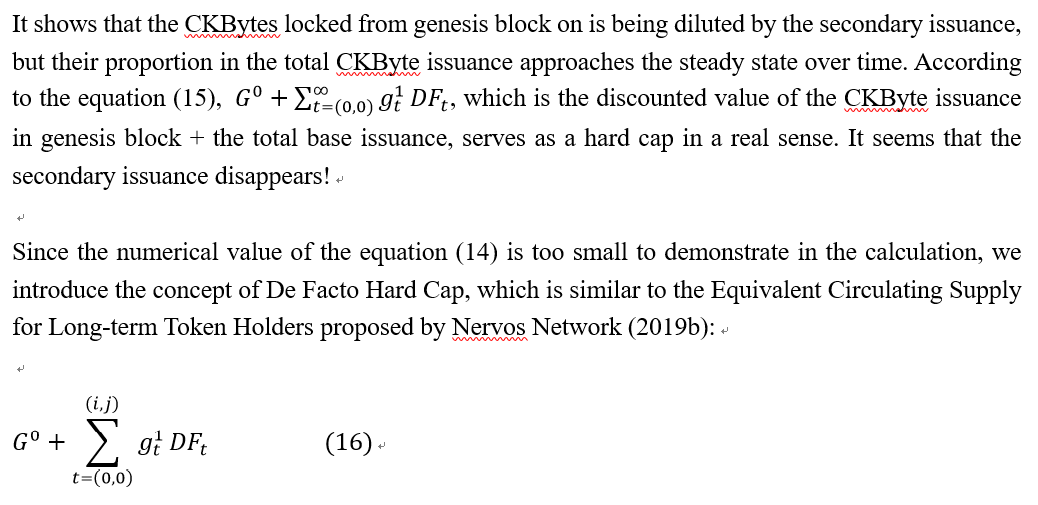

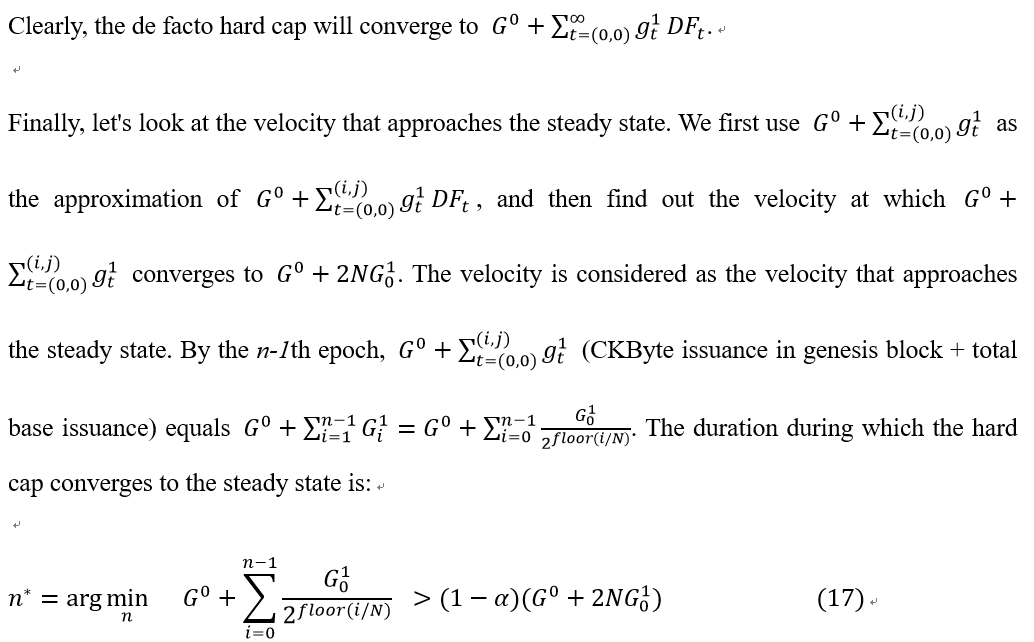

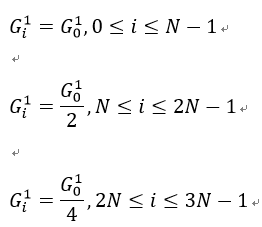

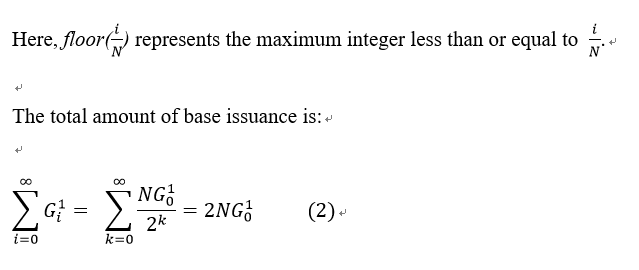

2.3.2 Steady State and Its Features

Here, α is a relatively small positive number, such as 5% or 10%.

3. A Numerical Test on CKByte Issuance Model

3.1 Parameter Settings

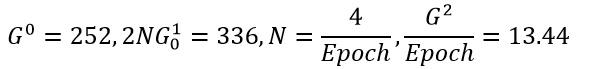

Nervos Network (2019b) provided key parameter settings. A total of 33.6 billion CKBytes is in the genesis block, with 8.4 billion CKBytes burned immediately. Hence the actual amount issued is 25.2 billion. The base issuance is 33.6 billion in total and halves every 4 years. The annual secondary issuance is 1.344 billion. By using the symbols above, the annual secondary issuance can be expressed as follows (which is measured in 100 million CKBytes):

As long as a value is given to Epoch, key parameters in the CKByte issuance model can be calculated with the equation (17).

3.2 Test Results

Let us take a look at the test results when the value of Epoch is 4.

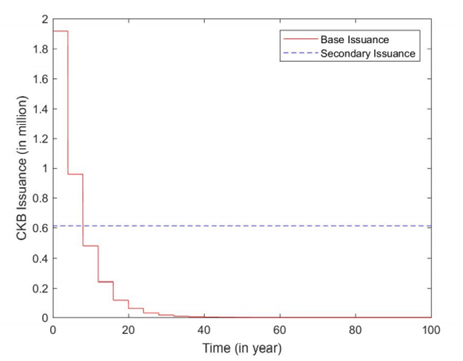

The figure 1 shows how the base issuance and secondary issuance at every epoch vary with time. When two halving periods end (after the mainnet has released 8 years), the base issuance will exceed the secondary issuance in every single block.

Figure 1: Base Issuance and Secondary Issuance

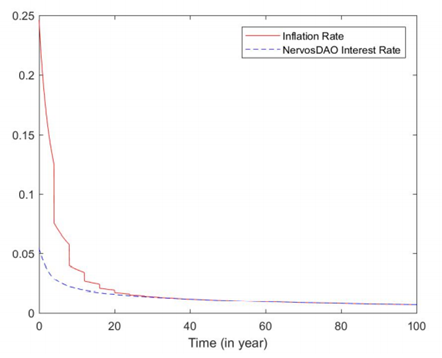

The figure 2 shows the inflation rate and NervosDAO interest rate at different points of time (They are both annualized). The former is always higher than the latter, but their difference will narrow down over time. After the mainnet has released 36 years, the inflation rate and NervosDAO interest rate will be basically the same (Their difference should be less than 1 basis point according to the standard).

Figure 2: Inflation Rate and NervosDAO Interest Rate

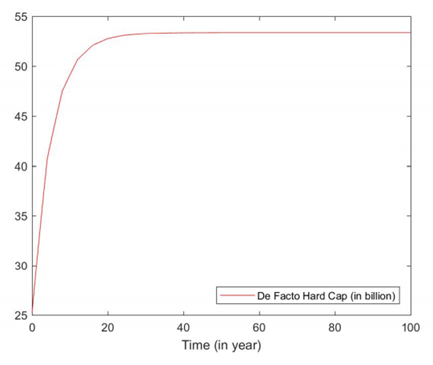

The figure 3 shows how the de facto hard cap varies with time. The steady-state value of the de facto hard cap is 53.36 billion. After the mainnet has released 9.25 years, the de facto hard cap will be close to the steady state (It should be higher than 90% of the steady-state value according to the standard).

Figure 3: De Facto Hard Cap

4. Conclusion

This paper is a technical supplement to Nervos’ crypto-economic paper drafted by Wang et al. (2019). First, it discusses the economic properties and the intrinsic price stability mechanism of CKB. Then, based on the key points of CKByte issuance model, it provides the mathematical expressions and analyzes the features of a steady state. Finally, a numerical test is conducted on the CKByte issuance model. With the help of this paper, the Nervos community can better understand how innovative the CKByte issuance model is as well as its economic meaning and features.

References

[1] Nervos Network, 2019a, “NervosDAO Proposal v5”.

[2] Nervos Network, 2019b, “Nervos CKB Official Public Sale Announcement”, https://medium.com/ nervosnetwork/nervos-ckb-official-public-sale-announcement-431438f4cc39

[3] Wang, Kevin, Jan Xie, Jiasun Li, and David Zou, 2019, “Crypto-Economics of the Nervos Common Knowledge Base”, https://github.com/nervosnetwork/rfcs/pull/78

[4] Zhang Ren, 2018, A Simple Consensus Protocol