January 5, 2019 Joel Monegro

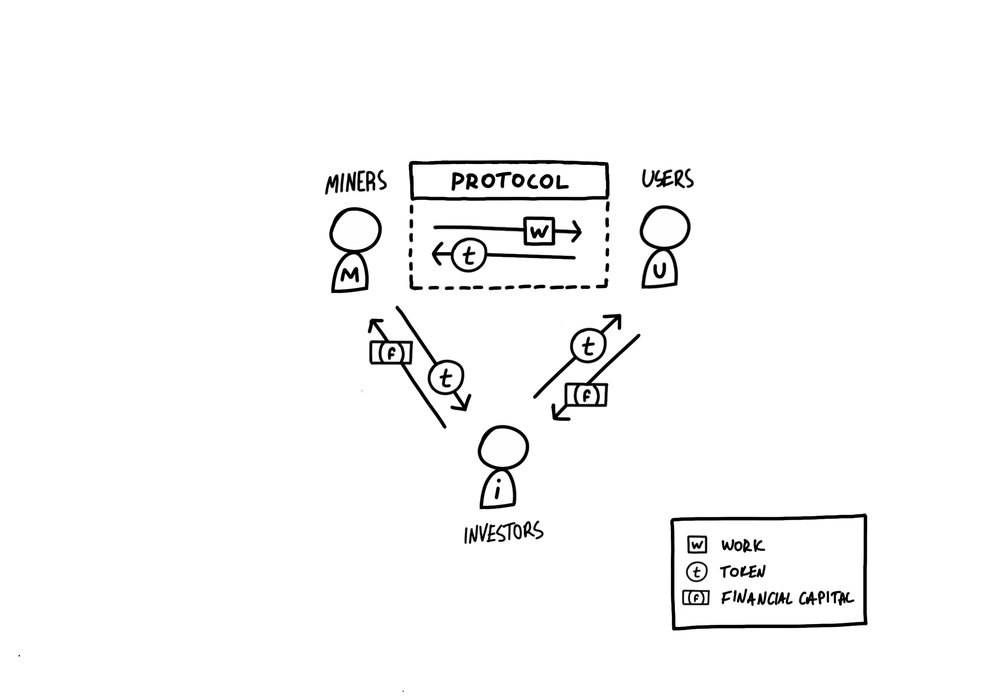

Cryptonetworks are online micro-economies organized around a specific service, and regulated by a cryptoeconomic protocol. The cryptoeconomic circle is a model I like to use to think about how value flows through different participants in these economies. It looks like this:

加密网络是围绕在特定服务的线上微经济,并且在加密经济协议的规范下。我喜欢用不同角色参与者导致的价值流转差异,来思考加密经济循环,大概长这个样子。

The Cryptoeconomic Circle

The model describes a three-sided market between miners (the supply side), users (the demand side), and investors (the capital side). Miners opt-in to the consensus protocol and coordinate their resources to provide the network’s service in a decentralized manner, users consume the service, and investors facilitate exchange while capitalizing the network.

该模型描述了矿工(供应方),用户(需求方)和投资方(资本方)之间的三方市场。矿工选择加入共识协议并协调其资源,以分散的方式提供网络安全,用户使用服务,投资者投入资金促进货币交易。

These groups exchange value with each other using the network’s own scarce cryptocurrency, or token. I call these interactions the miner-user , investor-miner , and investor-user relationships. They describe abstract flows of value, which can take many forms beyond direct transactions between two people.

这个组合使用自身稀缺的特质让加密货币相互交换价值。我将这些互动称为矿工用户,投资者 - 矿工,和投资者 - 用户,这三种关系。它们描述了抽象的价值流动,它可以采取多种形式,而不是两个人之间的直接交易。

The circle is simple by design so that it can be extended and modified. And it is visual, rather than mathematic, so that it can be used in a brainstorming or conversational context. The goal is not to describe the nuances of every network, but rather to provide a broad framework for thinking through cryptoeconomic design and network governance models.

圆形设计简单,可以扩展和修改。它是视觉的,而不是数学的,因此它可以用于头脑风暴或会话环境。目标不是描述每个网络的细微差别,而是为通过加密经济设计和网络治理模型提供思考的广泛框架。

Miners and Users

In the miner-user relationship, miners are compensated for their work through tokens. The network’s consensus protocol standardizes the service, while the cryptoeconomic model controls when and how miners get paid – typically when the network deems their work to be ‘correct’.

在矿工 - 用户关系中,矿工通过代币得到补偿。该网络的共识协议使服务标准化,而加密经济模型控制矿工何时以及如何获得报酬 - 通常是在网络认为他们的工作“正确”时。

Different services need different kinds of work, and users can transfer value in many ways, from direct payments to token inflation/deflation models. Bitcoin, for example, uses transaction fees and inflation to generate income for its miners. MakerDAO charges Dai users a stability fee which goes to buy-back and burn MKR, rewarding holders with increased ownership for assuming the system’s risk. Meanwhile FOAM cartographers, in a TCR model, can earn tokens for curating points on the map.

不同的服务需要不同类型的工作,用户可以通过多种方式转移价值,从直接支付到代币通货膨胀/通货紧缩模式。例如,比特币使用交易费和通货膨胀为其矿工创造收入。 MakerDAO向 Dai 用户收取稳定费用,用于回购并烧毁MKR,奖励持有者增加所有权以承担系统风险。同时,FOAM制图员可以在TCR模型中可以获得地图上策划点的代币。

This architecture is desirable when the benefits of a distributed supply side (such as lower costs of production, higher reliability and greater user leverage) outweigh the performance losses of decentralized systems.

当分布式供应方的好处超过分散式系统的性能损失时,这种架构是令人向往的(例如较低的生产成本,较高的可靠性和更高的用户利用率)。

Investors and Miners

There are short-term investors (traders), and long term investors (holders). Traders create liquidity for the token so miners can cover operational costs, while holders capitalize the network for growth by supporting token prices. The former is a direct form of value transfer where miners sell earned tokens in the open market to cover their costs and reinvest profits, and the latter is an indirect transfer of value that shows up in miners’ balance sheets rather than their income statements.

有短期投资者(交易员)和长期投资者(持有者)。交易员为代币创造流动性,因此矿工可以支付运营成本,而持有者通过支持代币价格使网络实现增长。前者是价值转移的直接形式,矿工在公开市场上出售赚取的代币,以支付其成本和再投资,后者是矿工间接的价值转移,显示在资产负债表而非损益表。

Different capitalization levels affect how the supply side develops. A cryptonetwork is fully capitalized when the price of its token is at a level where mining is breakeven. When prices fall below this level, the network is under-capitalized, mining is unprofitable and supply contracts. When prices rise above, it’s well capitalized and supply expands as the profit opportunity for miners grows. Therefore, by supporting certain price levels, holders (which often includes early miners and users) fund the supply in an indirect, but essential way.

不同的资本水平会影响供应方的发展方式。当代币的价格处于挖掘平衡的水平时,这个加密网络是完全资本化的。当价格低于这个水平时,网络资本不足,采矿无利可图。当价格上涨时,随着矿工的盈利机会增长,资本充足,供应量也会增加。因此,通过支持某些价格水平,持有人(通常包括早期矿工和用户)以间接但必不可少的方式提供资金。

In the beginnings of a cryptonetwork, investor capital stands-in for user demand as a way to help bootstrap the supply-side. Of course, it is possible to over- capitalize a network, which becomes a problem when capital withdraws as user demand fails to meet investors’ expectations, and sudden price drops take miners out of business. The key is to match network capitalization to fundamentals, which is a difficult task in absence of fundamental value models.

在加密网络的开端,投资者资本代替用户需求,作为帮助引导供应方的一种方式。当然,有可能过度将这个网络资本化,当资金退出时,由于用户需求无法满足投资者的预期而成为一个问题,突然的价格下降会使矿工停业。关键是要将网络资本化与基本面相匹配,在没有基本价值模型的情况下这是一项艰钜的任务。

Investors and Users

People who hold tokens as investments expect them to appreciate in value, which means demand for the scarce pool of tokens must increase over time. Generally, investors expect this to come from a growing user base in cases where tokens need to be spent to use the service. But demand can also be supply-driven, as with some proof-of-stake systems, or even investor-driven, at its most fickle. We can display these nuances by altering the direction of the arrows in the model, but in any case, investors help create long-term liquidity pools , available at different prices, from which new future demand can draw tokens.

持有代币作为投资的人期望他们的价值升值,这意味着对稀缺的代币库的需求必须随着时间的推移而增加。一般来说,投资者希望在需要使用代币来使用服务的情况下,这来自不断增长的用户群。但需求也可能是供应驱动的,就像一些股权证明制度,甚至是投资者驱动的,最为变化无常。我们可以通过改变模型中箭头的方向来显示这些细微差别,但无论如何,投资者可以帮助创建长期流动性池,以不同的价格提供,未来新的需求可以让代币获得成长。

Recycling the examples above, Bitcoin investors expect value to come from increasing demand for BTC as more people embrace the benefits of digital gold. MakerDAO investors expect growing demand for Dai to drive the value of MKR through consistent buy-back burns, and FOAM investors look to a future where the world deems it as important to be present on its map as it is to be on Google Maps, driving demand for its token (without getting into FOAM’s proof-of-location service).

重复上述例子,比特币投资者预计,随着越来越多的人接受数字黄金的好处,BTC的需求将增加。 MakerDAO投资者预计通过持续的回购销毁来增加对Dai的需求,并推动MKR的价值,同时FOAM的投资者期待未来的是界FOAM与Google地图将一样重要,这将会增加对代币的需求。

Another side effect of investor participation is supporting users’ purchasing power. In cases where the cost of service is set by competition among miners (i.e. prices float around the token), higher token prices increases the purchasing power of token holders, which may lead to increased consumption and therefore greater value for the network. But whether any of this works in practice cannot be generalized, and must be debated in the context of each network’s cryptoeconomic model. Nevertheless, the principal observation about the investor-user relationship remains: token liquidity and price support is as important for the demand side as it is for the supply side, and investors who participate through the open market contribute to both.

投资者参与的另一个副作用是对用户的购买力的支持。如果服务成本是由矿工之间的竞争决定的(即价格在代币周围浮动),则更高的代币价格会增加代币持有者的购买力,这可能导致消费增加,从而增加网络的价值。但是,这在实践中是否能有效扩展,必须在每个网络的加密经济模型的背景下进行辩论。然而,关于投资者 - 用户关系的主要观察仍然存在:象征性流动性和价格的支持,对需求方和供应方都同样重要,而通过公开市场参与的投资者对两者都有贡献。

Using the model

Isolating the different roles helps us analyze costs, incentives, and value flows for each group. It can also help us think about relative power and identify potential points of centralization, which is important to design more balanced governance and token distribution models.

隔离不同的角色有助于我们分析每个组的成本,激励和价值流。它还可以帮助我们思考相对权力并确定潜在的集中点,这对于设计更加平衡的治理和代币分布模型非常重要。

If you’ve been in crypto for a bit, none of these ideas may strike you as new. But looking at networks this way has led me to a few interesting ideas I’m cataloguing under the term crypto-capitalism, which I’ll expand upon in future posts. For example, it helped me see cryptonetworks as systems for exchanging labor for capital (vs. currency), the fundamental concepts of network capital , and what the different roles are for investors like us in the development of these new economies. The circle will serve as a baseline for these explorations.

如果你已经在加密经济体一段时间了,这些想法都不会让你感到新鲜。但是以这种方式看网络让我得到了一些有趣的想法,我在“加密资本主义”这个概念进行梳理,我将在未来的帖子中对其进行扩展。例如,它帮助我将加密网络视为劳动交换资本(对货币)的系统,网络资本的基本概念,同时也让我思考像我们这样的投资者在这些新经济体发展中扮演的不同角色。该循环将作为这些探索的基础。