Project

Strudel Finance

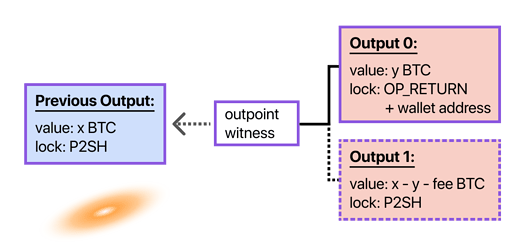

Strudel Finance is the first and only one-way, trustless bridging protocol linking Bitcoin (BTC), Bitcoin Cash (BCH), and future assets to DeFi. Through the use of Strudel’s secure protocol, bridging, liquidity mining, multi-chain support (Ethereum, Polygon, and BSC), and index fund options are available, with plans to incorporate lending and collateralization options in the near future.

One of Strudel’s main value propositions is its 100% trustless bridges which eliminates the need for custodial control of assets seen in typical wrappers. Vitalik Buterin indirectly mentioned a need for this value prop in a podcast with Lex Fridman recently. If you have time, it’s 1:53:06 to 1:57:40 on the YouTube video.

Not only is Strudel a bridging protocol, but we also aim to be a substantial source of value and passive income for investors. One of our recently implemented financial instruments is The Mare Imbrium Fund, a meticulously designed Balancer smart pool.

The Mare Fund is a low-risk, six-token, auto-balancing, and self-supporting index fund that gives exposure to three Strudel assets (vBTC, vBCH, and TRDL) with additional hedging and support provided by a stablecoin (oneVBTC), Ethereum, and a deflationary token (TWA). Investment of one asset (single-sided liquidity) provides demand for the other five tokens through arbitrage rebalancing inherent in these types of Balancer smart pools. The Mare Imbrium Fund was constructed to help support the market-driven peg prices of vBTC and vBCH and early returns have been positive. A pegged BTC and BCH are essential to fuel and grow our ecosystem, and all Strudel developments have that in mind.

Proposal overview

The link below gives a comprehensive overview of our plans with grant funds.

Built on Ethereum, live since Fall 2020. Polygon(Matic) and Binance Smart Chain since Spring 2021.

Proposal ask

$30k

- $5k upfront (ideally) for partial developer payment.

- $12.5K after launching a feature-complete product on testnet.

- $12.5K after GodWoken mainnet launch.

Metrics for success

Number of Bridge transactions and volume of funds transferred.

External links

Strudel website:

Pitch Deck:

Wiki:

Medium:

Mare Fund:

Github: