Team and Background

Founded in Nov 2021, with all the core team members from Amazon, MakerDAO. Our team possesses excellent capability in developing our very first project–Pulsar. The experience from Amazon endowed this team with adequate ability in fast project development (e.g. back-end and front-end coding, contract coding, etc) and prototyping. On the other hand, the knowledge and practices from MakerDAO gifted us insights and industry-level understandings on blockchain products, which helps us in perfecting our product in a community- and user-friendly way. We believe a team with such powers from both project development and project design would possess large odds in making a great product for the blockchain community.

Project Justification

Existing Limitations of DEX

Various DEX products are blooming in the DeFi market over the past 3 years. However, the existing ones suffer from some problems of different perspectives. For example, popular ones such as Uniswap focus on providing a platform that allows users to instantly exchange tokens at the cost of relatively large slippage when the size of the orders becomes large. Curve, on the other hand, mitigated the slippage issue for its constant-sum-based model though, the total amount of liquidity is limited as well. This restricts the amount of tokens in its exchange pools. Our product, in turn, aims to resolve these two existing problems in the current DEXes.

Motivation of Pulsar

Pulsar is a TWAMM protocol dedicated to enabling DeFi’s very low-cost, on-chain trading of large orders by way of AMM. It is a constant-product embedded AMM that combines instant swap (e.g. Uniswap) and term swap, which is designed to be beneficial for large order tradings.

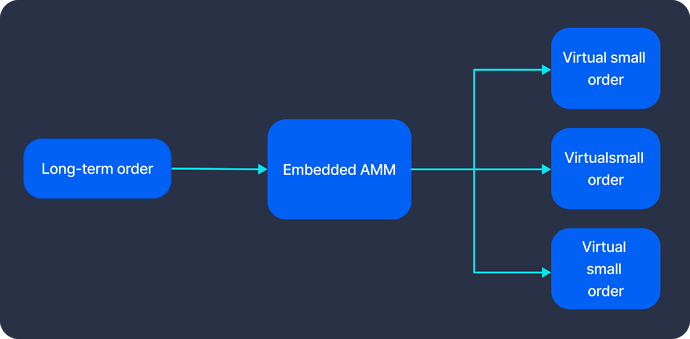

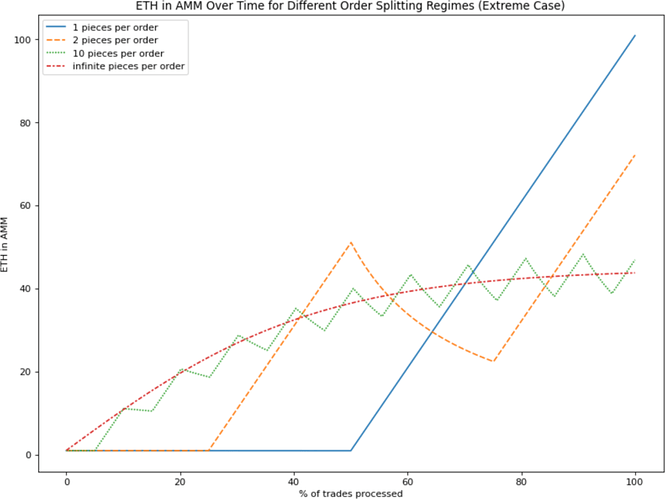

TWAMM is an AMM trading strategy designed by @Dave__White, @danrobinson, and @haydenzadams that is devised to execute large trades cost-effectively and slippage-friendly. TWAMM breaks long-term orders down into an infinite number of infinitely small virtual orders and executes swaps smoothly over time using an embedded AMM to avoid large slippage while maintaining gas fees that are close to the existing DEXes such as Uniswap. Market participants can submit large long-term orders on multiple blocks of Ethereum. It is the AMM and on-chain version of TWAP! As described above, this product is one of the solutions to the large orders–the original cause of large slippage in the existing. And because this TWAMM is a constant-product-based model, there is no such limitation to the liquidity pool volume (such as Curve has).

Moreover, it is well-known that AMMs have come a long way since the first-generation DEXes and are doing significant volumes today. They are great for the trading of small-cap long-tail of assets and bootstrapping liquidity for new projects. However, CEX is still the preferred way to trade larger-cap assets and larger volumes due to lower costs (tighter spreads, minimal gas costs, not having to worry about frontrunning in the mempool, etc) and zero slippage (e.g. order-book-based tradings). Before our product, no CEX replacement can handle on-chain large orders. Because of the low-cost and slippage-friendly nature of our product, Pulsar would provide an opportunity for users that seek for trading large orders on the blockchain without interferences with CEXes.

Here we include the key materials for our product in below:

- TWAMM WhitePaper: TWAMM

- Technical documentation for TWAMM protocol: https://showenpeng.gitbook.io/pulsar-twamm/

- Mathematical Principle of TWAMM: Mathematical Principle of TWAMM - HackMD

- GitHub: Pulsar Protocol · GitHub

- Demo Videos: Demo Viedos - Google 雲端硬碟

- Pulsar TWAMM Interface (Ethereum Ropsten Demo): https://twamm-interface.vercel.app

Technical Specification and Implementation

How does it work?

The TWAMM splits large orders into many small virtual orders and executes them slowly over time.

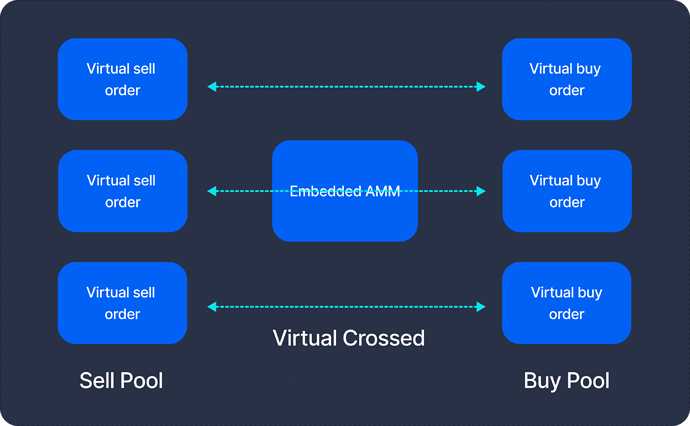

Virtual orders aren’t executed on-chain (as they would incur gas), but the Embedded AMM accounts for them. In this scenario, the buy & sell orders are virtually crossed and the on-chain “settlement” takes place later.

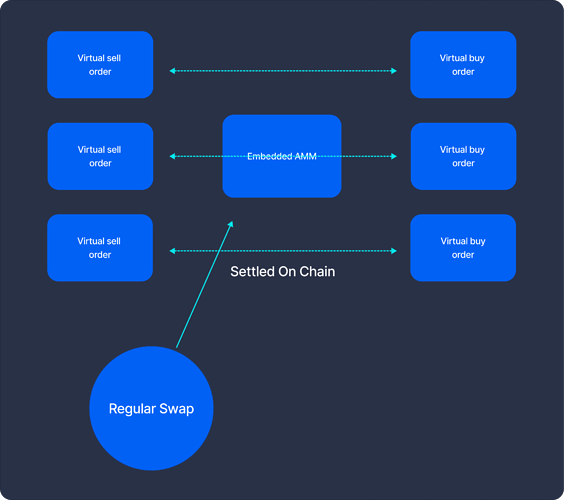

When the Embedded AMM receives a regular buy/sell order or a new large order, it will “wake up” & calculate the results of all the virtual trades that have taken place in the time that has since elapsed.

In this example, the virtual buy and sell orders that have been virtually crossed will be “settled”.

And there we have it, a DeFi-native novel way to TWAP a large order without incurring insane gas fees or causing too great of a price impact! Paradigm’s diagram illustrates this concept in a very neat way.

GodWoken Powering Pulsar

We chose to build on Nervos GodWoken because it has close-to-zero transaction fees and instant confirmation time for transactions. This efficient platform will be beneficial for users who frequently make transactions on Nervos for lowering their costs. Meanwhile, Nervos uses the UTXO model, which is the bookkeeping model for digital currencies like Bitcoin. We believe that the Layer 1-based UTXO blockchain can provide better security, privacy, and scalability to drive DeFi innovation to a greater extent.

By providing a handy tool for large order tradings (which never exists in any of the public chains), we believe this product can facilitate the decentralized ecosystem of Nervos in the same way it helps to popularize Pulsar.

Furthermore, Pulsar will integrate Force Bridge, a cross-chain bridge on Nervos that will allow users to smoothly cross ETH and ERC-20 tokens to Nervos eco-applications without the need for a trusted third party.

Roadmap

We propose a 6-month timeline, with 3 major checkpoints.

Checkpoint 1(1.5 Months):

- UX/UI

- TWAMM MVP model release

- Deploy MVP on GodWoken testnet

Checkpoint 2(3 Months):

- UX/UI

- TWAMM full version development

- Test add liquidity and remove liquidity

- Test instant swap and term swap

- Bug Improvements

- Documentation and its website development

Checkpoint 3 (1.5 Months):

- Full version TWAMM on GodWoken testnet

- TWAMM offline price algorithm

- TWAMM info

What’s Happening Simultaneously

- Contract audit

What Would Happen Eventually

- Full version TWAMM on GodWoken mainnet