What are CKBytes?

The Common Knowledge Byte (referred to as CKByte for short) is the native token of the Nervos Common Knowledge Base blockchain (a PoW based blockchain supporting multi-asset). It represents ownership of a piece of the CKB blockchain’s current state. For example, if Alice owns 1000 CKBytes, she can use those 1000 bytes to store assets, application state, or other types of common knowledge on the CKB blockchain.

CKBytes can be used as a means of resource management or as a store of value. CKByte ownership is analogous to land ownership, you can rent out your space, use it to store assets, smart contracts and other types of “common knowledge”, or for value preservation you can simply “hodl” in the NervosDAO.

CKByte Token Issuance

There are 33.6B CKBytes in the genesis block, another 33.6B CKBytes in the total base issuance and a continuous secondary issuance of 1.344B CKBytes per year.

Genesis Block

- 33.6B CKBytes in the genesis block, with 25%, or 8.4B CKBytes immediately burned (we will explain this later)

Base Issuance

- 33.6B CKBytes in total will be issued with annual base issuance halving every 4 years, similar to Bitcoin. The base issuance tokens can only be obtained via mining.

Secondary Issuance

- 1.344B CKBytes per year.

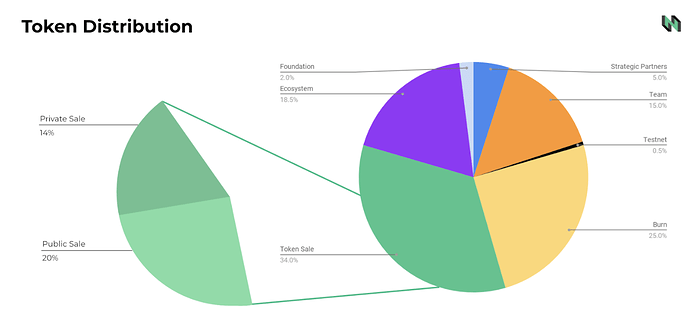

CKBytes Token Distribution

Genesis Block

The 33.6B CKBytes in the genesis block are distributed as follows:

Base Issuance

The base issuance of CKBytes is similar to the issuance of Bitcoin. Nervos CKB uses proof of work and incentivizes miners to recognize the longest chain as the network’s canonical state.

The base issuance reward halves approximately every 4 years, until all the base issuance tokens are mined out. All base issuance tokens are rewarded to miners as incentives to protect the network.

Secondary Issuance

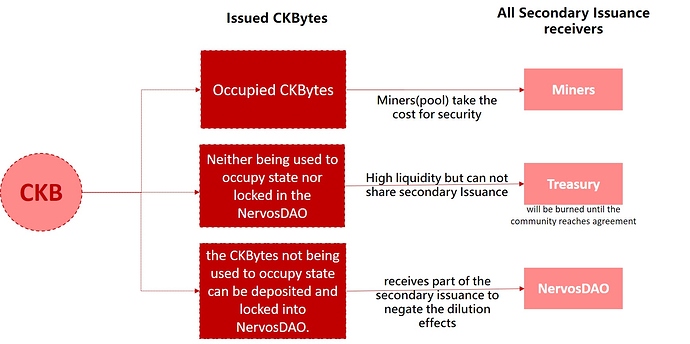

On top of the base issuance, we add a secondary issuance, which can be seen as an inflation tax on CKByte holders storing state on the blockchain. The CKBytes from secondary issuance will be distributed to 1) miners, 2) a special smart contract called the NervosDAO, and 3) the treasury.

Token holders using their CKBytes to store state (occupying state in the CKB blockchain) will not receive any CKBytes from the secondary issuance. This inflation tax is how they pay state rent to miners.

Users who hold CKBytes, but are not using them to occupy state, can deposit and lock their CKBytes into a special smart contract called the NervosDAO. The NervosDAO will receive part of the secondary issuance, and negate dilution effects to long-term holders.

- Miners will receive part of the secondary issuance proportional to “occupied CKBytes” divided by “all existing CKBytes”.

- NervosDAO Holders not using their CKBytes to occupy state can deposit and lock them into a special contract called the NervosDAO. The NervosDAO receives part of the secondary issuance and this negates the dilution effects to long-term holders.

- Treasury : For liquid CKBytes, which are neither being used to occupy state nor locked in the NervosDAO, secondary issuance rewards will go toward the treasury, providing sustainable funding for protocol maintenance and ecosystem development. The treasury won’t be activated until the Nervos Foundation has spent the ecosystem fund that’s reserved in the genesis block. Before the treasury is activated, this portion of secondary issuance will be burned. The treasury will be activated upon approval through the governance mechanism and implemented through a hard-fork.

To demonstrate how secondary issuance is divided, let’s suppose at the time of a secondary issuance event, 60% of all CKBytes are being used to store state, 35% of all CKBytes are deposited and locked in the NervosDAO, and 5% of all CKBytes are kept liquid. 60% of the secondary issuance will go to miners, 35% of the issuance will go to the NervosDAO (distributed proportional to locked tokens). Use of the rest of the secondary issuance — in this example, 5%, will be burned until the treasury is activated.

After base issuance stops, there will only be a secondary issuance of 1.344B CKBytes per year.

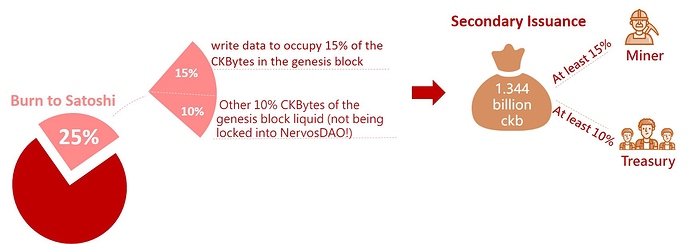

The Token “Burn” Explain

Why bother to burn 25% of the tokens in the genesis block? Why not just issue fewer tokens?

When we say “burn 25% of Nervos CKBytes in genesis block”, the 8.4 billion CKBytes will be sent to an address owned by Satoshi. This essentially means that no one will move or touch those tokens (unless Satoshi comes back and that would be another story :P).

The 8.4 billion CKBytes will not disappear (as normally you will assume burned=disappear), more importantly, it will have an impact on the secondary issuance.

The Nervos Foundation will write data to occupy 15% of the CKBytes in the genesis block, while leaving the other 10% CKBytes of the genesis block liquid (not being locked into NervosDAO!)

In this way, even if no CKBytes are being used to store state, or if all circulating CKBytes are deposited into the NervosDAO, miners and the treasury will still receive CKBytes from secondary issuance.

Please note: It won’t always be that 15% of secondary issuance goes to the miners and 10% goes to the treasury. Those number will go down as more tokens are mined out. The diagram above says “at least” which is only accurate at the time when the network launch.

Thanks to Williams Lai, knwang, Matt Quinn, Kim Fournier, Ben Waters and Jan Xie for reviewing this article.

Originally published on Medium