New to the NERVOS Forum. Self-intro: Securities industry professional, entered crypto in 2020, OG “old leek.”

I’ve followed CKB since its early days (notably via Aaron Brown’s Bloomberg article “Cryptocurrencies Await Four Key Developments”). Later, I watched its price decline steadily and bought in at ~$0.003 on Binance in late 2023. Since then, I’ve tracked its technical updates—most are beyond my expertise, but RGB++’s vision to unify UTXO chains (especially Bitcoin and Lightning Network payments) stood out.

Recently, during extended stays in Hong Kong, stablecoins dominate conversations. The U.S. moves fast: USDT and USDC already dominate dollar-pegged markets. The next global focus will undoubtedly be the Eastern superpower. Conflux aggressively promotes its “Belt and Road” and RWA narratives, but I remain skeptical due to geopolitical risks—true decentralization is non-negotiable. Nervos, as a POW chain with relentless innovation, seems better positioned. Can it seize this opportunity?

3 Likes

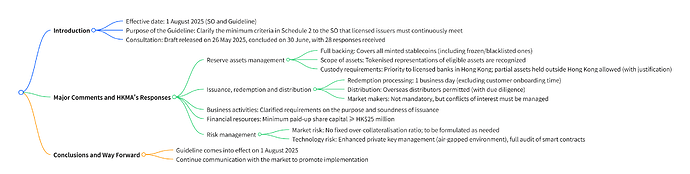

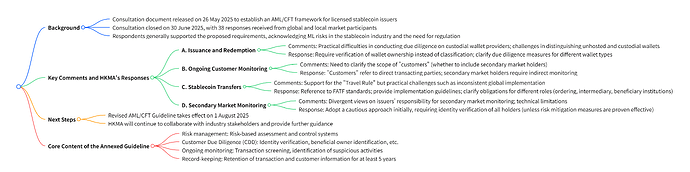

Hong Kong released regulatory guidelines for stablecoins yesterday, which contain many details about KYC and AML. I have made a simple summary of them.

你说得很对,对于希望参与国际化竞争的公链来说,真正的去中心化是不可妥协的。CKB 是PoW公链,且通过RGB++打通了与BTC以及Doge等UTXO链,做到了真正的去中心化。目前,香港稳定币发行方案还处于讨论阶段,我觉得CKB可以讲一个在BTC上发行稳定币,并通过RGB++来到ckb上使用defi,以及进入闪电网络支付的故事,这是完全不一样的稳定币故事。这是绝对的创新,当然对机构来说,也意味着一定的风险。不过,谁知道呢,我们可以在香港进行一些尝试和发声。此外,在比特币主网发行稳定币并转账,以及leap这些都已经被 USDI 验证过了。

3 Likes

如果可以做到在BTC上发行稳定币,那确实是一个很不一样的特点,如果把CKB作为BTC的整体的一部分来看,是一个非常不错的定位。

在稳定币之外,更应该关注的是应用场景与资产,可目前看噪声比较大。我最近在内地和香港看了很多RWA项目,与区块链行业从业人员做了不少交流,他们告诉我,现在很想当年的ICO。我虽然没有经历过ICO,但是我非常了解互联网金融。目前很多的RWA并没有走合规的监管体系,只讲收益,不谈风险的做法实际上会让投资人血本无归,对于大部分创业者来说,讲的是销售能力而不是技术或产品本身。我不清楚港府是否了解RWA当前的现状,而后采取严厉监管做法,不过从朋友们口中看,内地的区块链环境大概也是这种原因走向了另一个极端。

另一方面,为什么RWA这么热,是因为除了募资之外,RWA把大陆的资产到海外完成了募资,这一点当然是发行方的需求,但实际上也是内地监管非常在意的点,具体原因大家完全可以理解。

总结我的观点,BTC的稳定币非常不错,希望CKB能抓住机会。目前的RWA本质只是融资,拼的是销售,还算不上场景,且很可能抓不到机会。

1 Like

If stablecoins could be issued on BTC, that would be a truly unique feature. If CKB is considered part of the BTC ecosystem, it has a very good positioning.

Beyond stablecoins, we should focus more on application scenarios and assets, but currently, there’s a lot of noise. I’ve recently visited many RWA projects in mainland China and Hong Kong and had many discussions with blockchain industry professionals. They told me that they miss the days of ICOs. While I haven’t experienced an ICO, I’m very familiar with internet finance. Currently, many RWAs don’t follow a compliant regulatory system. Their focus on returns, regardless of risks, can actually lead to investors losing everything. For most entrepreneurs, sales skills are the key, not the technology or product itself. I’m not sure if the Hong Kong government understands the current state of RWAs and is subsequently implementing strict regulatory measures. However, from what I’ve heard from friends, the mainland’s blockchain environment has likely reached an extreme for this very reason.

On the other hand, the reason why RWAs are so popular is that, in addition to fundraising, they leverage mainland assets to raise funds overseas. This is certainly a requirement for issuers, but it’s also a point of great concern for mainland regulators. The specific reasons are completely understandable.

In summary, BTC’s stablecoin is excellent, and I hope CKB can seize the opportunity. Currently, RWAs are essentially just fundraising, relying on sales, and lack a real-world application, and are likely to miss opportunities.